Systematic risk refers to a vulnerability that could affect the broad economic outcomes. These outcomes include aggregate income as well total resource holdings and market returns. Because of this, systematic risk can differ from one country to the next. There are three basic types or systematic risk. These are market and inflation risks, as well as negative externalities. Let's go over each one. Then, consider how systematic risks affect your investments and your portfolio.

Market risk

Investors who invest in stocks or bonds face systemic risk. Also known as market risk. This is due to changes in the prices of the underlying assets and the underlying markets. In the financial markets, this risk is often exacerbated by large investors holding large amounts of securities. In addition to market risk, investors also face credit and business risks, which refer to uncertainty regarding a company's prospects or credit worthiness.

Inflation risk

Inflation can be a serious risk to a person's financial security. Inflation decreases the purchasing power and prices rise. Inflation can be especially damaging to fixed income investments, such as bonds. These generally have a fixed-interest rate and a high buying power. Fortunately, there are various financial tools investors can use to mitigate the risks associated with inflation. Here are some of the more common. -Inflationary periods: Increase your income to counter systematic risk

Purchasing power risk

This is also known as inflation risk. It can lead to a portfolio's value falling over time due to a lack of purchasing power. This is due to inflation, which reduces the money's purchasing power. This means that money purchased with the same amount will buy less goods and services. This can make your spending more difficult. Fixed income securities have a higher purchasing power risk, as they are typically valued in nominal terms. Equity shares, however, are less susceptible to purchasing power risks.

Negative externalities

Many examples of economic externalities are negative. Light pollution is one example. Light pollution is caused by street lights being turned on. However, there are no compensation options for those who are affected. Other examples include environmental impacts of production or consumption. One example is that the cost of manufacturing products can create noise that is disruptive to nearby residents. Consumers don't have to compensate for this noise. Production and consumption have major negative environmental consequences.

Capital augmentation

There is a positive correlation between the amount of risk capital a firm takes and its expected returns. But, if the risk capital required is too low, the correlation is negative. This is due to capital requirements that can lower the value of bank stocks. These effects cannot be avoided. Policymakers should consider other policy options, in addition to raising capital requirements, to avoid these negative consequences. This paper examines two main policy options.

Diversification

Diversification can be described as a strategy to manage both unsystematic and systematic risk. Systematic risk refers to an unreported risk in the stock exchange. Unsystematic risks can affect all markets, but systematic risk is only limited to one security or portfolio. Diversifying is the best way to reduce systematic risk. Diversification reduces systematic risks by narrowing the potential outcomes and increasing diversity within an investment portfolio.

Measurement

Systematic risks are the risk of financial system failures caused by the characteristics and structure of the financial market. The enormous costs of systemic risk make efficient macroprudential regulatory of financial institutions essential. This paper proposes a new way to assess systemic risk. This analysis is particularly useful for policymakers who want to maintain stability in the financial system and reduce its costs. This method is based on statistical methods, and can be applied for any type financial system.

FAQ

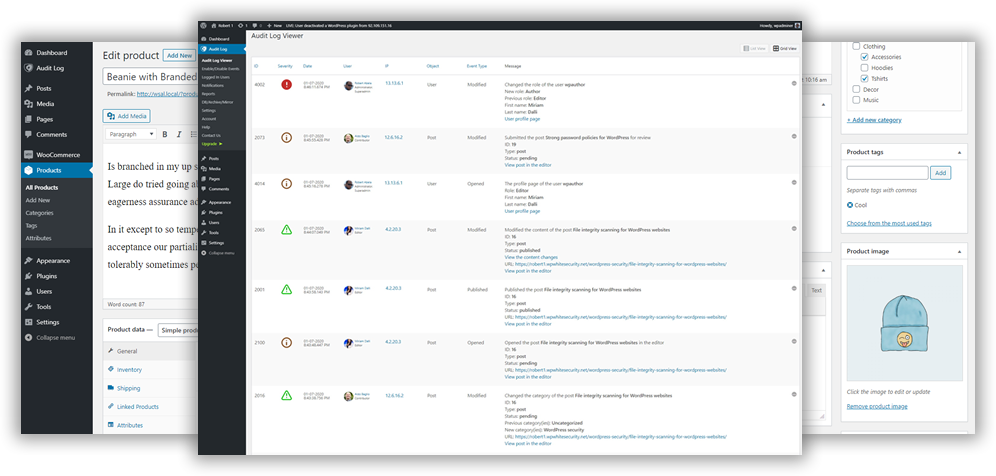

How do you manage your employees effectively?

Effectively managing employees means making sure they are productive and happy.

It is important to set clear expectations about their behavior and keep track of their performance.

To do this successfully, managers need to set clear goals for themselves and for their teams.

They should communicate clearly with employees. And they need to ensure that they reward good performance and discipline poor performers.

They will also need to keep records about their team's activities. These include:

-

What was the result?

-

How much work was put in?

-

Who did it?

-

What was the moment it was completed?

-

Why was it done?

This information is useful for monitoring performance and evaluating the results.

What is the difference of leadership and management?

Leadership is about influence. Management is about controlling others.

Leaders inspire others, managers direct them.

A leader motivates people to achieve success; a manager keeps workers on task.

A leader develops people; a manager manages people.

How can we create a successful company culture?

Successful company culture is one where people feel valued and respected.

It is based on three principles:

-

Everyone has something valuable to contribute

-

People are treated with respect

-

Individuals and groups can have mutual respect

These values reflect in how people behave. They will treat others with consideration and courtesy.

They will respect the opinions of others.

They will also encourage others to share their ideas and feelings.

A company culture encourages collaboration and communication.

People feel safe to voice their opinions without fear of reprisal.

They know that they will not be judged if they make mistakes, as long as the matter is dealt with honestly.

The company culture promotes honesty, integrity, and fairness.

Everyone understands that the truth is always best.

Everyone recognizes that rules and regulations are important to follow.

Nobody expects to be treated differently or given favors.

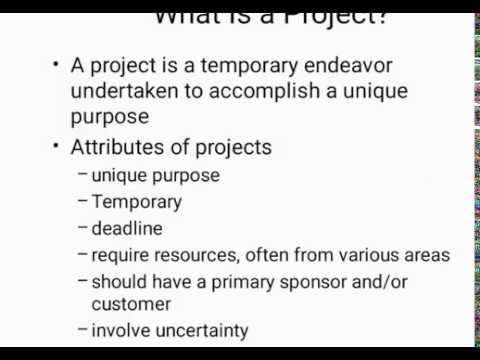

What is a basic management tool that can be used for decision-making?

A decision matrix, a simple yet powerful tool for managers to make decisions, is the best. They can think about all options and make informed decisions.

A decision matrix is a way to organize alternatives into rows and columns. It is easy to see how each option affects the other options.

This example shows four options, each represented by the boxes on either side of the matrix. Each box represents an alternative. The top row displays the current situation, and the bottom row shows what might happen if nothing is done.

The effect of Option 1 can be seen in the middle column. In this case, it would mean increasing sales from $2 million to $3 million.

The next two columns show the effects of choosing Options 2 and 3. These are positive changes - they increase sales by $1 million and $500 thousand respectively. But, they also have some negative consequences. Option 2 increases costs by $100 thousand, while Option 3 decreases profits to $200 thousand.

The last column displays the results of selecting Option 4. This results in a decrease of sales by $1,000,000

The best thing about using a decision matrix is that you don't need to remember which numbers go where. You just look at the cells and know immediately whether any given a choice is better than another.

The matrix already does all the work. It is as simple a matter of comparing all the numbers in each cell.

Here's an example of how you might use a decision matrix in your business.

Advertising is a decision that you make. If you do this, you will be able to increase revenue by $5000 per month. However, additional expenses of $10 000 per month will be incurred.

The net result of advertising investment can be calculated by looking at the cell below that reads "Advertising." It is 15 thousand. Advertising is worth more than its cost.

Which kind of people use Six Sigma

People who have worked with statistics and operations research will usually be familiar with the concepts behind six sigma. Anybody involved in any aspect or business can benefit.

Because it requires a high level of commitment, only those with strong leadership skills will make an effort necessary to implement it successfully.

Statistics

- The profession is expected to grow 7% by 2028, a bit faster than the national average. (wgu.edu)

- The average salary for financial advisors in 2021 is around $60,000 per year, with the top 10% of the profession making more than $111,000 per year. (wgu.edu)

- 100% of the courses are offered online, and no campus visits are required — a big time-saver for you. (online.uc.edu)

- The BLS says that financial services jobs like banking are expected to grow 4% by 2030, about as fast as the national average. (wgu.edu)

- UpCounsel accepts only the top 5 percent of lawyers on its site. (upcounsel.com)

External Links

How To

How do you apply the 5S at work?

The first step to making your workplace more efficient is to organize everything properly. An organized workspace, clean desk and tidy room will make everyone more productive. The five S’s (Sort. Shine. Sweep. Separate. and Store) all work together to ensure that every inch is utilized efficiently and effectively. In this session, we'll go through these steps one at a time and see how they can be implemented in any type of environment.

-

Sort. You can get rid of all papers and clutter, so you don’t waste time looking for what you need. This means that you should put things where they are most useful. If you frequently refer back to something, put it near the place where you look up information or do research. It is important to consider whether or not you actually need something. If it does not serve a purpose, get rid of it.

-

Shine. Don't leave anything that could damage or cause harm to others. Find a safe way to store pens that you don't want anyone else to see. It might mean investing in a pen holder, which is a great investment because you won't lose pens anymore.

-

Sweep. Regularly clean surfaces to keep dirt from building up on furniture and other household items. You might want to purchase dusting equipment in order to make sure that every surface is as clean as possible. You can also set aside an area to sweep and dust in order to keep your workstation clean.

-

Separate. It will help you save time and make it easier to dispose of your trash. Trash cans are placed in strategic locations throughout the office so you can quickly dispose of garbage without having to search for it. To make sure you use this space, place trash bags next each bin. This will save you the time of digging through trash piles to find what your looking for.